Loan Calculator

Calculate fixed monthly payments for any amortizing loan, including personal, auto, and mortgage loans, using the standard financial formula Online.

years

months

Results:

| Payment Every Month | |

| Total of 120 Payments | |

| Total Interest |

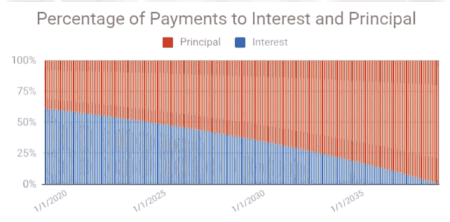

■ Principal

■ Interest

Deferred Payment Loan: Paying Back a Lump Sum Due at Maturity

years

months

Results:

| Amount Due at Loan Maturity | |

| Total Interest |

■ Principal

■ Interest

Calculation Examples

📋Steps to Calculate

-

Enter loan amount, interest rate, and term.

-

Choose term in years or months.

-

Click "Calculate" for payment details.

Mistakes to Avoid ⚠️

- Forgetting to factor in extra one-time fees (origination, processing) that increase the true cost of borrowing.

- Confusing the total number of payments (n) with the loan term in years.

- Assuming a "personal loan" calculator includes the complex variables required for a full mortgage calculation (taxes, insurance, PMI).

- Failing to re-check rates as credit scores or market conditions change.

Practical Applications📊

Calculate payments for car or personal loan planning.

Use with our Amortization Calculator to track interest savings.

Test various interest rates to optimize your loan strategy.

Questions and Answers

What is a loan calculator?

A loan calc helps you to estimate the regular installments and total interest associated with personal loans or mortgage loans. You just need to provide your loan amount, interest rate, term, and they will provide a repayment schedule.

How do I calculate loan payments?

To calculate loan payments, enter the credit amount, annual interest rate, and repayment term in our loan payment calculator. The calculator provides your monthly payment and total cost instantaneously with no further action needed.

Is this calculator accurate?

The provided results are accurate for standard loans. They may differ for other types of loans.

Can I use a loan estimator for a mortgage?

Indeed. Our mortgage loan amount calculator also calculates monthly payments and interest as well as serves as a home loan calculator. Change the terms to frame an affordable payment plan that fits your budget.

How does interest affect my loan?

Interest affects the overall amount that needs to be repaid, hence increasing the total cost of your loan. Check how different interest rates impact your monthly payment through our Financing interest calculator.

Which formulas are used in Loan Calculator?

Using the standard amortization equation, CalcMate computes the monthly payment as: $M = P \frac{r(1+r)^n}{(1+r)^n - 1}$. In this formula, $P$ is the principal, $r$ is the periodic interest rate, and $n$ is the total number of installments. This ensures consistency with Federal Reserve borrowing standards.

Is this calculator accurate for all types of loans?

Our tool is highly accurate for standard fixed-rate, fully amortized loans. Results may differ for variable-rate loans (like some mortgages), loans with balloon payments, or loans calculated on a simple interest basis.

How does the loan term influence monthly payments and interest?

A shorter loan term results in a higher fixed monthly payment but drastically reduces the total amount of interest paid. A longer term provides lower monthly payments but costs much more in interest over the life of the loan.

Can I calculate student loan payments with this tool?

Yes, the calculator works well for standard, fixed-rate student loans. For complex, income-driven repayment (IDR) plans, you must use a specialized servicer’s tool for accurate results.

Disclaimer: This calculator is designed to provide helpful estimates for informational purposes. While we strive for accuracy, financial (or medical) results can vary based on local laws and individual circumstances. We recommend consulting with a professional advisor for critical decisions.